What does renting a house vs buying a house have to do with the difference between term and permanent life insurance? Let’s find out!

Term Life Insurance

Think of term life insurance as a temporary form of coverage that you can choose for a specific period, like 10, 20, or 30 years. It provides a death benefit to your loved ones if you pass away during the term. This type of policy is often more affordable compared to permanent life insurance.

Here’s an analogy: Imagine you’re renting a house. You pay a monthly rent for a fixed period, say, two years. If something happens to you during those two years, your loved ones would receive a payout from the landlord (the insurance company) in the form of a death benefit. But once the term ends, the coverage expires, just like your lease agreement.

Permanent Life Insurance

Permanent life insurance, on the other hand, is more like buying a house instead of renting. It provides coverage for your entire lifetime, as long as you pay the premiums. In addition to the death benefit, permanent life insurance policies often have a cash value component that grows over time. This cash value can be used for various purposes, like borrowing against it or even as an investment.

To continue the analogy, imagine you buy a house that you own forever. As long as you keep up with the mortgage payments (premiums), you and your loved ones will always have that house (coverage) and the added benefit of accumulating equity (cash value).

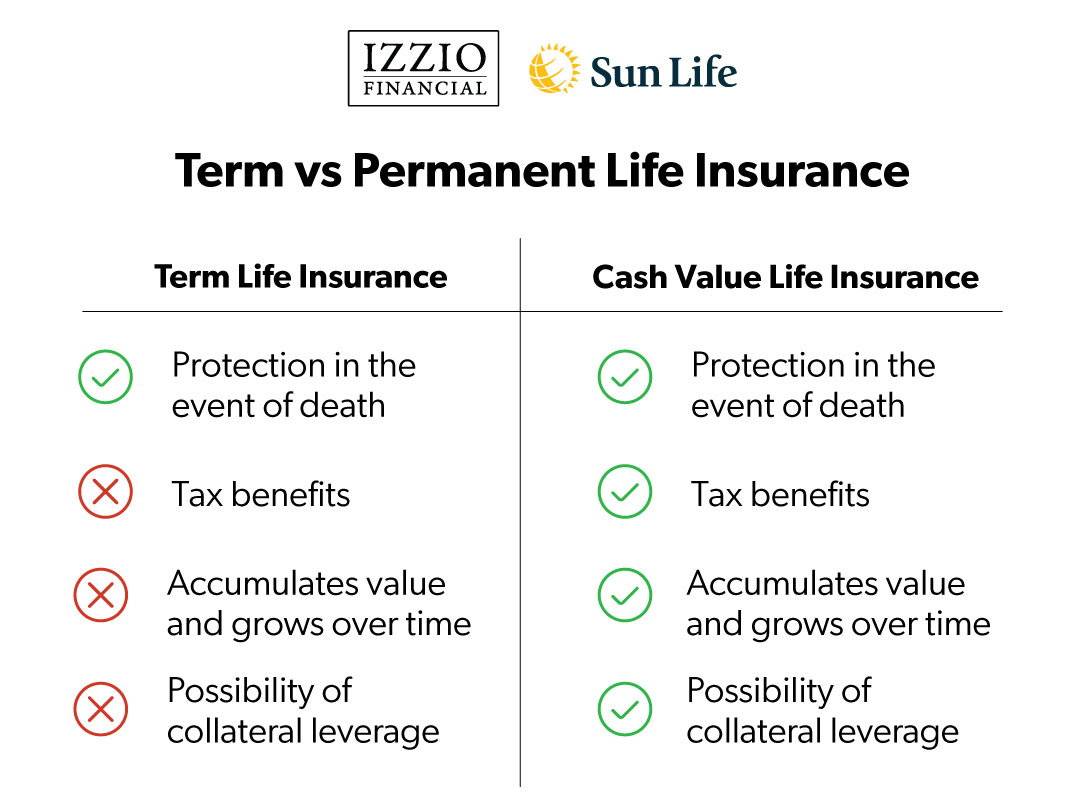

In summary:

- Term life insurance is like renting; it provides coverage for a specific period, and if you pass away during that time, your beneficiaries receive a payout.

- Permanent life insurance is like buying a house; it offers coverage for your entire life, and it may also have a cash value component that grows over time.

When deciding between the two, it’s important to consider your specific needs, budget, and long-term goals. Speaking with a licensed insurance professional can help you understand which type of life insurance is most suitable for your situation.

When deciding between the two, it’s important to consider your specific needs, budget, and long-term goals. Speaking with a licensed insurance professional can help you understand which type of life insurance is most suitable for your situation.